1984

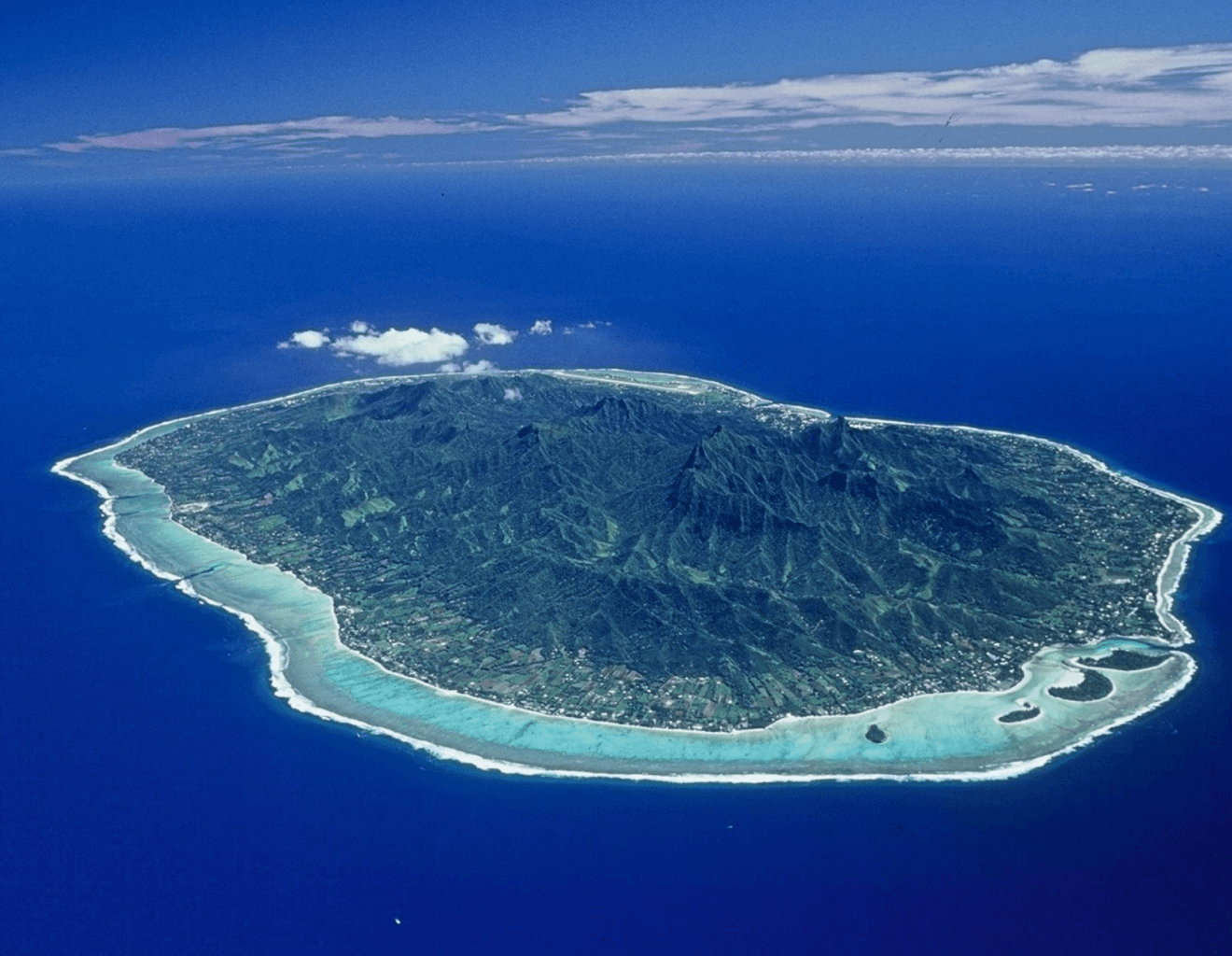

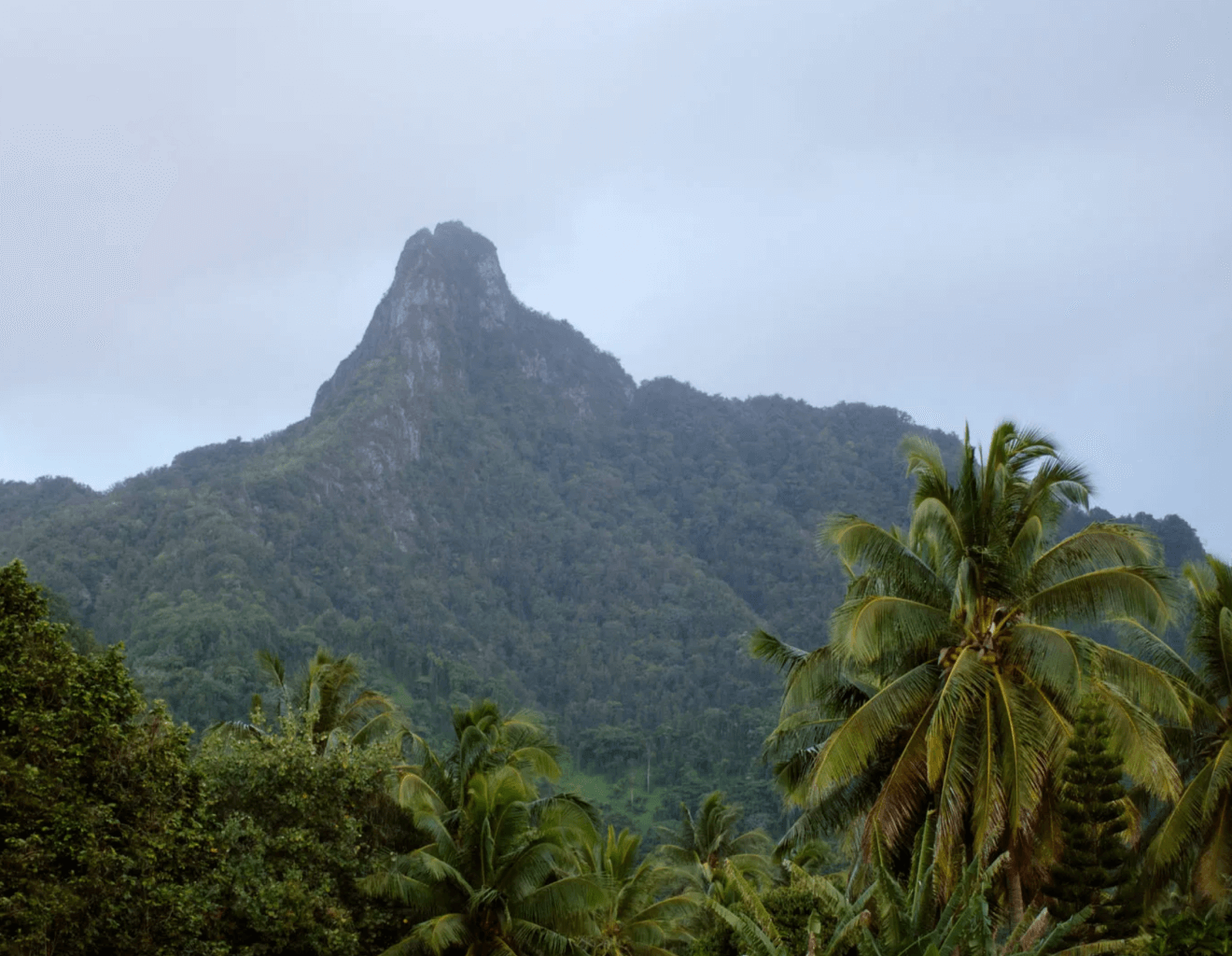

In 1984, the Cook Islands enacted the International Trusts Act as part of an early shift toward building an international financial services sector alongside tourism, to support economic diversification. The Act created a statutory basis for international trusts administered by licensed Cook Islands trustees, and it helped anchor the jurisdiction’s financial services offering for offshore clients.